Donald Trump's recent Middle East policies bring to mind the old saying, "Even a broken clock is right twice a day." The same can be said about the right-wing think tank Illinois Policy Institute. They're almost always wrong about sustainable transportation issues. But once in a while they happen to be correct about something, usually transit-related housing policy.

Three recent Illinois Policy blog posts are a great example of the fractured timepiece axiom. Yes, two of them are garbage, but the third one is golden.

First, let's backtrack a bit to the last time Streetsblog Chicago felt the need to mercilessly razz our conservative colleagues in an article. And it wasn't just us: suburban transit whiz Star:Line Chicago and Springfield pundit Capitol Fax's Rich Miller initiated the fun.

In an October 25 Daily Herald column titled, "Suburban businesses should beware new taxes disguised as 'solutions'" IPI CEO Matt Paprocki wrote the following about the transit bill negotiations happening during the fall veto session:

"If lawmakers want transit to thrive, they should focus on safety, reliability and efficiency, including increasing police presence on public transit, consolidating duplicate roles across agencies, cutting wasteful spending and enforcing on-time and on-budget capital projects, and aligning service with demand. They also could encourage denser housing development and upzoning near transit to grow riders."

"[The Northern Illinois Transit Authority] bill (HB 3438) does literally all of this," Star:Line responded. "[The] 'IPI, read the actual bill' challenge remains undefeated."

Miller was even harsher. "Um, [Paprocki] just basically described the transit bill," he wrote. "And there’s no way to finish the job w/o providing more revenue, which he of course rejects... I dunno, maybe newspapers should vet their op-ed submissions a bit more?"

Wow, cue the "Mean Girls" GIFs! But it was all in good fun or, rather, part of the process of getting a robust transit bill approved, never mind the naysayers.

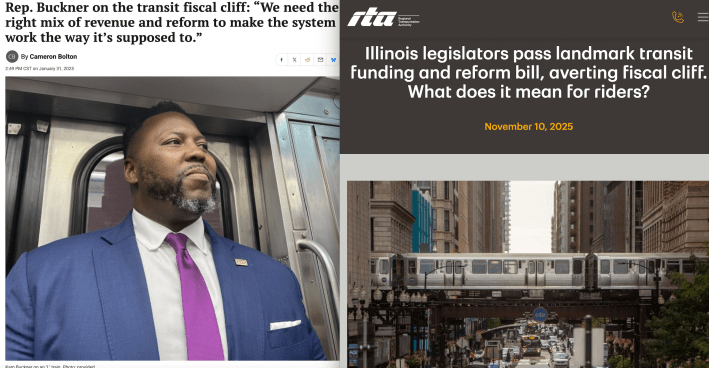

And even Rep. Kam Buckner, one of the architects of the final legislation, took a poke at Paprocki's demand for Champagne transit on a beer budget. "Everybody wants to go to heaven, but nobody wants to die," he quipped in an interview with SBC.

So at least four different factions ridiculed Paprocki's rhetoric, but it appears Illinois Policy didn't learn anything from that spanking. Last week IPI Policy Researcher Ravi Mishra made the same kind of mistakes in not one but two similarly laughable blog posts.

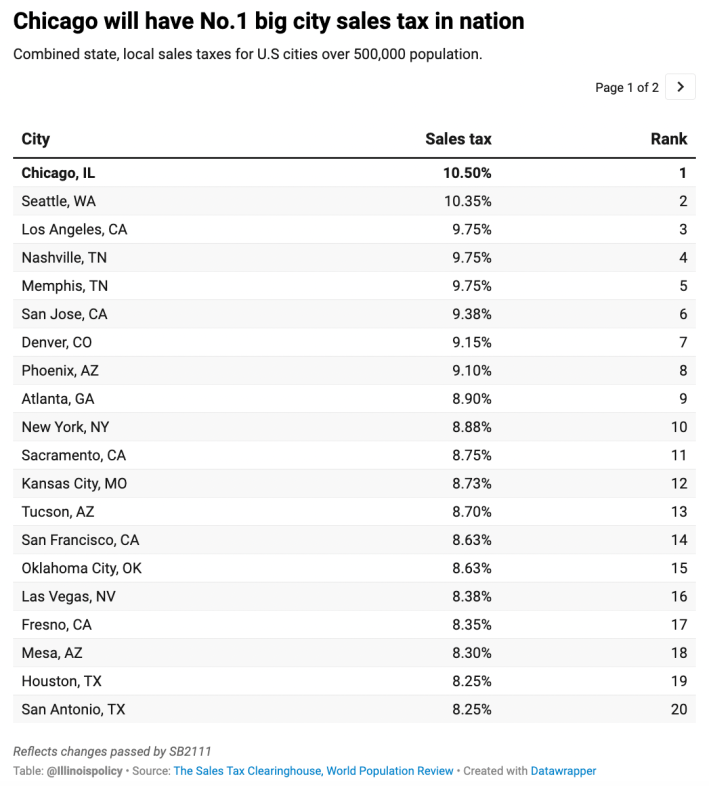

"Chicago’s high sales taxes about to increase to No. 1 in nation," Mishra wrote in the first one. Well, yes, the part of northeast Illinois served by the CTA, Metra, and Pace will see a $0.25 percent sales tax increase to fund transit, but at a single quarter per $100 purchase, that won't be a major burden for anyone.

And you get what you pay for. It's probably no coincidence that most large U.S. cities with decent transit nowadays – including Chicago, Seattle, Los Angeles, Denver, NYC, and San Francisco – are on the above list. Moreover, one of the common strategies for funding excellent public transportation in Europe is Value Added Taxes of over 20 percent, which saves residents money in the long run.

Even though the Chicagoland tax increase to fund transit will only be a penny on a $4.00 purchase, Mishra argues it's a serious equity issue. "Sales taxes tend to hit low-income households the hardest, because a larger share of their incomes go towards basic necessities. Those will cost more under these rates."

You know what would hit low-income households even harder? Having to buy a car because of slashed transit service.

Is the 0.25% RTA sales tax increase to fund transit "regressive"? It's not ideal, but paying an extra quarter for a $100 purchase should not be a major hardship.It's certainly less regressive than transit cuts that would have forced people to drive.@rtachicago.bsky.social @atalliance.bsky.social

— Streetsblog Chicago (@chi.streetsblog.org) 2025-11-03T18:59:01.351Z

Like Paprocki, Mishra condescendingly tells the lawmakers, "True fiscal stability requires reform, not just more revenue."

You mean, "No revenue without reform!", the battlecry that transit-friendly state legislators, agencies, and advocates have been repeating for as long as we can remember?

"RTA must prioritize cost savings, modernize its fare policy and improve performance standards," Mishra adds. That is, mandates that are explicitly stated in the final bill that passed, SB 2111? SMDH!

There was more of the same in Mishra's other Illinois Policy post last week, "Transit fares frozen as Chicago drivers hit with 45-cent toll hikes" the researcher gripes, "Some of the hikes lawmakers rushed through on Oct. 31 were not even necessary to close RTA’s budget gaps." Well, yes, the idea behind the $1.5 billion in annual state funding was not just to preserve the less-than-satisfactory status quo but improve service and avoid future fiscal cliffs.

Regarding Mishra's implication that transit fares should be going up in 2026, here's what Sen. Ram Villivalam, who led the transit reform/funding effort in the state senate, told SBC about that issue earlier this month. "On fare increases, when you talk to people that are riding the system today, they are not satisfied with the service as-is," Villivalam said. "Our deliberations and thought process on that was to stabilize the system with funding, transform the system with reforms, and after a year's time, having the new entity that will be in place, NITA, evaluate how fares need to be adjusted."

"Instead of addressing duplicative spending and outdated scheduling, lawmakers boosted the same bureaucracy that created this problem," Mishra insisted last week. The words "Northern Illinois Transit Authority" don't even appear in his article. Was he somehow unaware that lawmakers did not boost the same bureaucracy, but NITA will have instead have more power to make decisions about policy, fares, coordinating service, security, capital expenditures, and more?

"The RTA needs reform if it wants to solve its underlying issues without unfairly punishing taxpayers," Mishra concludes. "This means prioritizing cost savings, modernizing fare policy and improving performance standards."

Sorry readers, but I am not going to explain for umpteenth time in the same article what's wrong with this statement.

But to return to my busted chronometer metaphor, IPI Policy Researcher LyLena Estabine's blog post last week, "Housing gets boost by easing parking lot mandates near transit," is right on time.

"Illinois state lawmakers just removed minimum parking space requirements for developments near transit hubs, a major win for housing affordability and production statewide," Estabine comments. "Importantly, this legislation doesn’t mean developers will stop building parking. The People Over Parking Act simply gives them flexibility to provide only what’s needed. It allows housing to be built where residents may not need or want parking, keeping prices lower and production more feasible."

Indeed, Steven Vance and Ben Wolfenstein have made similar points about the measure in articles for Streetsblog Chicago.

Excellent work, Ms. Estabine. No notes.

Read the Daily Herald op-ed here.

Read the Capitol Fax post here.

Read IPI's "Chicago’s high sales taxes about to increase to No. 1 in nation" here.

Read IPI's "Transit fares frozen as Chicago drivers hit with 45-cent toll hikes" here.

Read IPI's "Housing gets boost by easing parking lot mandates near transit" here.

On November 12, SBC launched our 2026 fund drive to raise $50K through ad sales and donations. That will complete next year's budget, at a time when it's tough to find grant money. Big thanks to all the readers who have chipped in so far to help keep this site rolling all next year! Currently, we're at $1900, with $48,100 to go, ideally within three months.

If you value our livable streets reporting and advocacy, please consider making a tax-exempt end-of-year gift here. If you can afford a contribution of $100 or more, consider it a subscription. That will help keep the site paywall-free for people on tighter budgets, as well as decision-makers. Thanks for your support!

– John Greenfield, editor