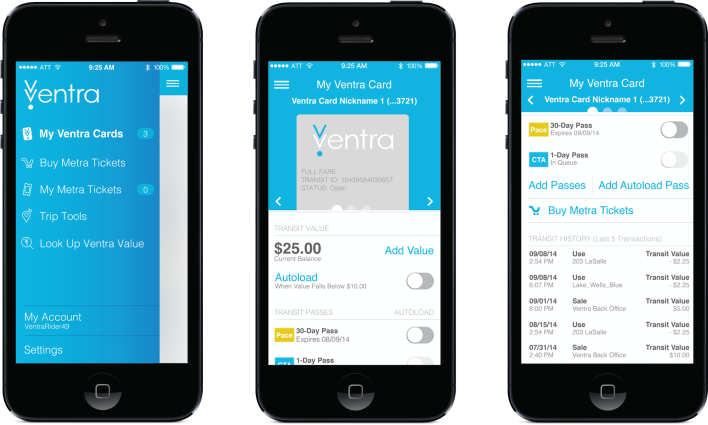

The forthcoming smartphone ticket app for Metra will also make it possible for Chicago Transit Authority and Pace customers to manage their Ventra transit accounts on their phones, the CTA announced last week. Even though the three agencies will spend $2.5 million on the app (plus nearly $16,000 in monthly fees), the Ventra app won't at first offer customers many more functions than the existing Ventra website.

CTA communications manager Tony Coppoletta pointed out to Streetsblog that the 80 percent of CTA customers who have smartphones could use the app to skip the lines at station vending machines or at Ventra retailers, and have easier on-the-go access to their Ventra accounts. Bus passengers, who currently have to go out of their way to reload their Ventra accounts, may find the app particularly useful.

As we've reported before, the app will also help occasional Metra riders by finally making it possible to instantly purchase Metra tickets from anywhere. For example, an individual who loads $130 every month in pre-tax transit benefits into into a Ventra account could purchase a $100 monthly CTA/Pace pass, and still have $30 each month to spend on Metra tickets.

Yet many transit riders won't benefit from the app. The 20 percent of CTA riders who don't have smartphones, and others who don't use bank cards, add up to hundreds of thousands who won't be able to use the app. Many more CTA riders automatically deposit funds into their Ventra accounts, using Ventra's auto-load function or pre-tax transit benefits. Similarly, any Metra riders who don't have smartphones will still have to buy their tickets by mail or in person.

Two more crucial technologies that would further simplify transit payments are still set for the indefinite future. First, 1.5 million Ventra customers still won't be able to tap their cards to pay aboard Metra, as they already do aboard CTA and Pace buses. Metra says that their contract with Cubic Transportation Systems, Ventra's creator, allows them to test a device that can read Ventra cards on board trains – but Metra hasn't decided whether to bother with the test.

Also left out from Ventra so far are the new "contactless" payments that other companies are rapidly latching on to. RFID-equipped bank cards (issued under brand names like PayWave, PayPass, or ExpressPay) and now NFC-equipped smartphones (running apps like Softcard, Apple Pay, or Google Wallet) can currently pay single fares and load passes at stations and retail shops to board CTA and Pace.

Ventra has long promised that anyone using such a bank card or smartphone would eventually be allowed to set up a Ventra account (or link to an existing account), which would allow customers to use transfers, buy passes, and receive transit benefits on their existing RFID bank card or NFC smartphone -- and making the plastic Ventra card obsolete. An NFC-equipped smartphone with the Ventra app could then be used to pay fares aboard CTA, Pace and Metra, at long last creating a "universal fare card" valid across the region.

CTA points out that this capability would be especially useful for visitors. In the future, a visitor arriving at Union Station or O'Hare airport could use the Ventra app to instantly buy a one- or three-day pass while walking to the CTA station, just tap their phone to board buses and trains, and skip the $5 Ventra card purchase entirely. The same visitor could also, of course, use the Ventra app to buy Metra tickets as well.

This "third-party registration" hasn't happened yet due to a programming snafu. The new contactless chips generate fresh card numbers each time they're used -- a security feature that complicates Ventra's ability to identify the chip. CTA is testing a solution, but can't say when it will launch.

CTA and Cubic have hired Globe Sherpa, which built an app serving 140,000 customers a day on TriMet in Portland, to develop the Ventra app. The CTA told Streetsblog that the three agencies are deeply involved in the app's development and will test the app with at least 100 riders.