The Illinois Department of Transportation is moving forward with its portion of the 47-mile Illiana Tollway in rural Illinois and Indiana, issuing a "request for qualifications" to potential contractors. The document sheds light on how the state intends to finance the billion-dollar highway -- and how taxpayers will be on the hook.

To get the greenfield highway built sooner, IDOT wants a private contractor to obtain all the financing necessary to construct and "turn on" the tollway, but a big chunk of this financing will come in the form of public support. IDOT tells potential bidders that it estimates the total amount of financing needed at $1.09 billion. Only some of that will be raised from private backers, while a big chunk will come from $500 million in borrowing (or more, according to one analysis) backed by Illinois taxpayers. IDOT also revealed in the RFQ that it will assist the developer in obtaining a subsidized TIFIA loan from the federal government.

This is the first time IDOT has noted how it plans use taxpayer funds to kickstart the project. In theory, the portion of the financing backed by the public could be paid off using toll revenues. But according to an analysis by the Chicago Metropolitan Area for Planning, it will take decades until toll revenues cover both construction debt and maintenance costs. In the meantime, taxpayers will be on the hook, subsidizing this expensive boondoggle.

A report conducted for Indiana’s DOT in June 2010, when construction costs were estimated at the slightly higher price of $1.25 billion, said that toll revenues would leave a shocking $809 million gap. Metropolitan Planning Council’s review of the report [PDF] showed that tolls "will only be able to support... $441 million." The Chicago Metropolitan Agency for Planning estimated the gap could be as high as "$1.1 billion over the life of the facility" [PDF].

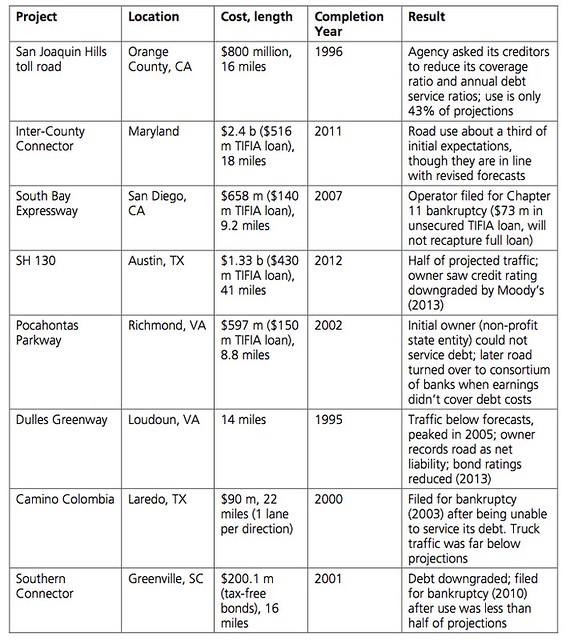

The risk to taxpayers could be even greater. Nationwide, newly built tollways are struggling to cover their costs and meet projections:

State highway 130 in Austin, Texas, has seen only half the projected traffic and had its credit rating downgraded twice this year, with a high likelihood of default. The South Bay Expressway, a toll road near San Diego, California, was owned and operated by Macquarie but filed for bankruptcy after less than three years -- it’s now owned by SANDAG, the local metropolitan planning organization. The Intercounty Connector in the DC region is having the same issues: Tolls are less than expected and tolls across Maryland were raised to pay for it while the state raided its transportation fund (which also pays for transit) and turned to general obligation bonds to pay for $445 million. To top it off, three of the five bus routes that use it -- part of the highway’s selling point -- are being cut.

All of these roads received TIFIA loans, but the Austin and San Diego highways differ from Illiana because they used a traditional concession model, where the state sells the companies the right to build and operate the tollway and receive the toll revenues for themselves. The Austin road got the rest of its funding from banks. AASHTO, a trade group representing state transportation departments, notes that there is less risk to the private investor with the "availability payments" mechanism that IDOT will be using -- in which the state pays the contractor a series of agreed-upon payments based on its performance -- than with a full concession.

Tolls on the Illiana are estimated by IDOT to be some of the highest in the nation, at $7 for the whole trip, or 15-25 cents per mile, twice as much as the average charge in Chicagoland.

Fitch Ratings warned this year that several factors make toll road building sketchy for investors, reporting that "caution remains warranted when future projections are the basis for investment," that the decline in driving could negatively affect toll roads, and that toll roads designed to relieve congestion -- a benefit IDOT has continually touted -- that have "un-tolled competition... could be vulnerable because their value would diminish with slower traffic growth."

IDOT secretary Ann Schneider told the Tribune that the agency will drop the project if it "cannot find suitable investors" or if the Illiana "can’t withstand official scrutiny."

Statements of qualifications are due December 19 and shortlisted firms will be notified in January. (Indiana DOT is running on a slightly delayed timeline and has indicated they will issue the final request for proposals in May and sign a deal in November 2014.)