The Chicago Metropolitan Agency for Planning is the official regional planning agency for northeastern Illinois, and they're required by federal law to design and maintain a comprehensive plan which guides how some federal grants are spent in Cook, DuPage, Kane, Kendall, Lake, McHenry, and Will counties.

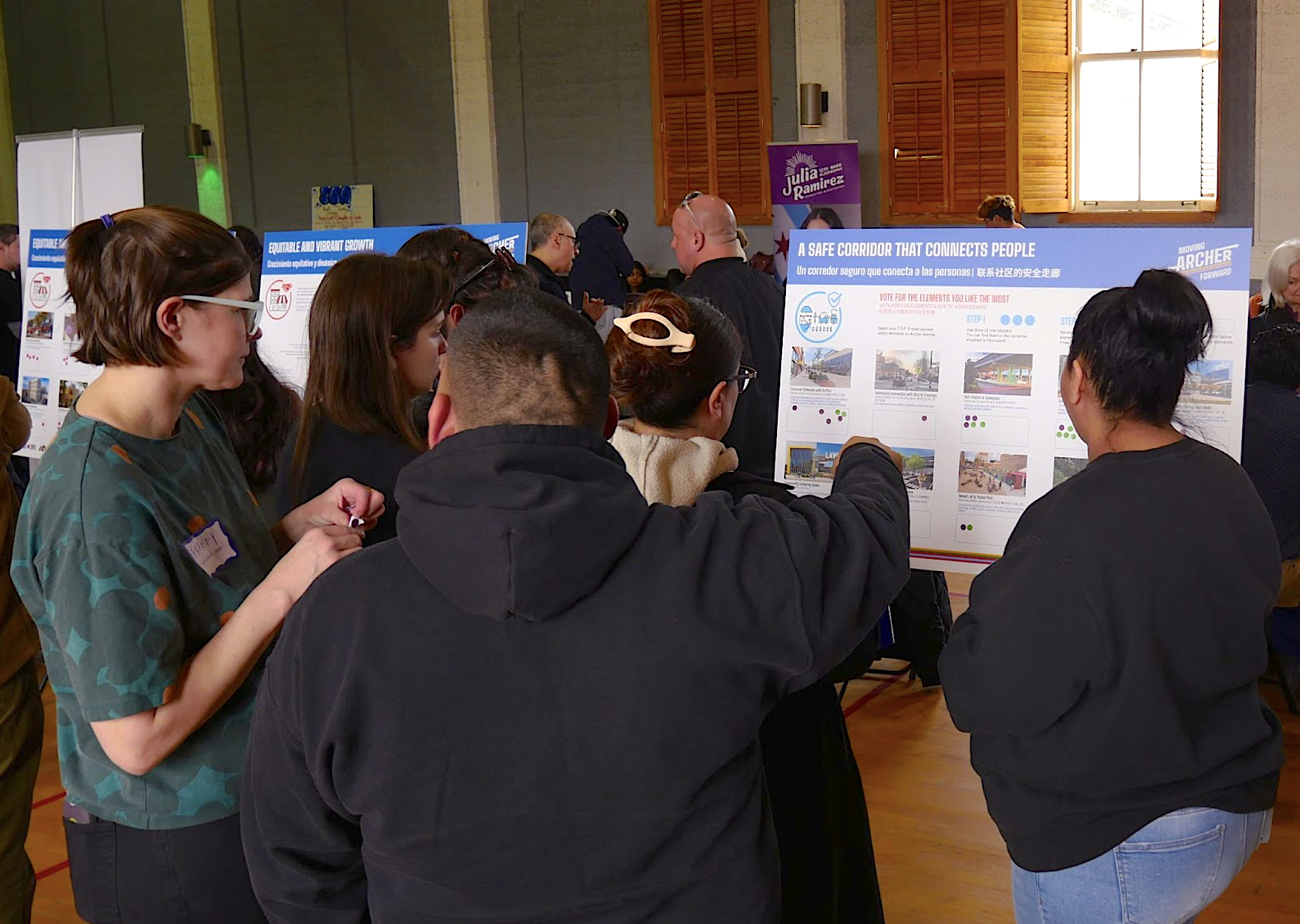

The organization is creating a new long-range plan called ON TO 2050, to be completed and adopted in October 2018. During the development of the plan, staff need to figure out what the priorities for land use and transportation in the region should be, and they're gathering input by talking to hundreds of residents, organization leaders, and elected officials. Those talks are synthesized in early "strategy papers."

The strategy paper Expanding Housing Choice (PDF) explores local and current issues that affect – and in some cases prevent – the preservation or construction of affordable housing in Chicago and the region.

One section about the federal role in supporting mixed-use and walkable neighborhoods caught my eye. It was actually about the lack of funding the federal government generally has for these neighborhoods, and how money is balanced in favor of single-use, single-family areas. Here's the passage:

Americans increasingly prefer to live in walkable neighborhoods that mix commercial amenities with single-family, townhome, and multi-family homes (i.e. mixed-use neighborhoods). Yet, federal housing rules favor homeowners over renters and single-family homes over multifamily homes, and create policy barriers to market changes.

Specifically, CMAP planners write, projects with ground floor retail and apartments above frequently struggle to qualify for federal financing and loan guarantees. "The U.S. Department of Housing and Urban Development (HUD), Federal Housing Administration (FHA), and Fannie Mae and Freddie Mac programs all limit the amount of non-residential space allowed within developments as a condition for receiving federal financing or loan guarantees."

Freddie Mac rules, for example, allow a maximum of 20 percent for non-residential use. Therefore, "the building must be at least five stories to accommodate ground-floor retail." That characteristic may make the building "out of scale with existing communities or noncompliant with existing zoning regulations.”

In other words, a property owner is allowed a very low maximum of commercial or retail space in a building when getting funding or guarantees from those federal programs.

The paper will probably have to be updated constantly as the current turmoil in the Trump administration will likely find its way to the housing department. But, hey, Trump's Housing and Urban Development secretary Ben Carson will sort it out, even though he had zero experience in the field before he was appointed. After all, housing policy isn't exactly brain surgery, right?

I've summarized the rest of the paper on Chicago Cityscape.

CMAP is holding meetings and public forums across the region this year and next, and will be collecting feedback until the plan is finalized in one and a half years.