On May 31 as the spring Illinois legislative session was wrapping up, the Senate passed the transit funding and reform bill HB3438. It included the last-minute addition of a "climate impact fee of $1.50 [for] each retail delivery that meets specified conditions."

However, the Illinois House declined to bring the legislation to a vote that night, and the legislative session ended without addressing Chicagoland's impending $771 million transit fiscal cliff. That means CTA, Metra, and Pace service could be cut some 40 percent next year, with roughly 3,000 layoffs.

Rep. Kam Buckner (D-Chicago), one of the leading public transportation advocates in Springfield, later told the Tribune that House members had little advanced warning about the delivery fee in the bill. Therefore, he felt it would be "disingenuous" and "irresponsible" to call a vote on it. At last Tuesday's City Club panel on the future of local public transportation, Rep. Buckner expressed hope that lawmakers will come together for an emergency session to plug the transit budget hole this August during the Illinois State Fair.

Detractors quickly labeled the proposed $1.50 app-based delivery surcharge a "Pizza tax." A DoorDash spokesperson claimed to Eater Chicago that such services aren’t "just for fancy sushi dinners" because they "[bridge] the gap for families living in food deserts who need groceries, and [help] low-income customers stretch their already-strained budgets further."

In reality, the bill explicitly states (see Article 12, P. 15, in the amendment), "The climate impact fee shall not apply to the delivery of groceries." The legislation also excludes "prescription and non-prescription drugs and medications."

But I was initially somewhat sympathetic to the argument the proposed fee was regressive, since it would charge the same amount to people of all income levels. And, while crumbling transit in Chicagoland would economically impact all of Illinois, and the bill would also fund downstate bus systems, it seemed a little unfair to make Decatur residents pay the same delivery fee as folks in Des Plaines.

I was also puzzled why I hadn't heard about any discussion at the capitol of "flexing funding," using money from Illinois' share of the federal Highway Trust Fund to subsidize transit. Since there's currently more Highway Trust funding available than usual, that would still leave plenty of money for fixing roads. In November 2024, Pennsylvania Governor Josh Shapiro used this approach to allocate $153 million to Philadelphia's SEPTA transit system.

So a week after the #TransitFundingIndecision2025 debacle I posted this slightly tongue-in-cheek blurb on Streetsblog's social media accounts.

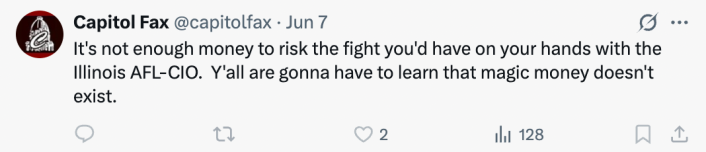

Rich Miller, editor or the Springfield news website Capitol Fax, got in on the Twitter discussion to argue flexing funding would be a non-starter in the Land of Lincoln. He claimed that Labor unions would never allow any money to be diverted from the highway fund, despite the fact that flexing funding probably wouldn't deprive their members of any roadwork income.

Last Tuesday, Miller included my "pizza tax" tweet in a Capitol Fax article critiquing a recent Streetsblog guest op-ed by Ellen Steinke about Labor and Uber's role in defeating the transit funding and reform bill. (See our response to his critique at the bottom of the SBC op-ed.) In his piece, Miller referred to the $1.50 fee as "a tax on deliveries, which Streetsblog ridiculed."

Around that time, I noticed the handle "Tax Burrito Taxis" on Chicagoland transit advocate social media. The catchphrase implied that, since it's not completely necessary to get restaurant food delivered by drivers, the $1.50 climate impact fee to fund transit is a good idea.

Since then, I've taken a closer look at the language of the bill the Senate passed (the "Retail Delivery Climate Impact Fee Act" is Article 12 of an HB3438 amendment, on Page 15) and had more conversations about the legislation. I now believe the proposal is more equitable and sensible than I'd originally assumed.

The policy is worth supporting because it helps mitigate the many downsides of widespread deliveries made by motor vehicle drivers. "In recent years, the number of retail deliveries of tangible personal property, including restaurant food, has rapidly increased, and this rapid growth is expected to continue," the Senate bill amendment notes. "The World Economic Forum estimates that by 2030 there will be over 30 percent more delivery vehicles on roads to deliver 78 percent more packages, which will increase usage of the highways, roads, and streets of the state by motor vehicles used to make retail deliveries, traffic congestion, and retail delivery-related emissions." That's not to mention more traffic crashes, injuries, and fatalities, and the related societal costs.

The $1.50 fee would encourage consumers to make fewer of these kinds of purchases. For example, if you were to avoid buying one retail item at a time but instead bundle several into a single delivery, you'd save money, and help reduce vehicle miles traveled. Minnesota and Colorado have implemented similar retail delivery fees.

And there are ways to avoid the charge altogether. Again, the fee wouldn't apply to groceries and medicine. So if there are reasons you need to have food delivered, you could opt out of the charge by ordering groceries you can cook, or just heat up, instead of getting hot prepared meals from restaurants.

Moreover, the legislation says the surcharge only applies to items "delivered by a motor vehicle." (According to the Illinois Vehicle Code, electric bicycles that travel 28 mph or less – the electrical assist on e-Divvies tops off at 20 mph – are not classified as "motor vehicles.") Therefore, you could skip the surcharge by ordering from establishments that use bicycle delivery or other non-motorized methods.

And this would encourage more eatery and retail business owners to offer car-free deliveries in order to attract thrifty customers. Helping to save the planet would be the icing on the (restaurant-prepared) cake.

Moreover, it's not just progressive politicians who've said they might endorse at least part of the climate impact fee strategy. Republican State Rep. Brad Stephens of Blue Line-served Rosemont recently told the Daily Herald, "I may be able to support a certain portion of that."

Better Government Association President and CEO David Greising, who moderated Tuesday's City Club panel, noted some of the other transit funding options being considered in a Tribune op-ed yesterday.

• A 50 cent tollway surcharge capped at a dollar a day. 25 percent of tollway fees come from non-Illinoisans, so that could be a win for our state.

• Modest transit fare increases. Greising noted CTA fares haven't risen since 2018. The 'L' fare set at that time was $2.50, $3.20 in today's money. So raising the fare to $2.75 would be totally reasonable and would likely not drive away many riders.

• "A proposed 10 percent tax on ride-[hail] services across the region makes sense," Greising wrote. Indeed, rampant Uber and Lyft use makes traffic crashes, pollution, and congestion more common, while transit use does the opposite, so this would be completely fair.

But I'm now also convinced the Retail Delivery Climate Impact Fee, aka the "Burrito Taxi Tax," would be stuffed with societal benefits.

Did you appreciate this post? Streetsblog Chicago is currently fundraising to help cover our 2025-26 budget. If you appreciate our reporting and advocacy on local sustainable transportation issues, please consider making a tax-deductible donation here. Thank you!