Last week, the Metropolitan Planning Council hosted “Paying by the mile: A new way to fund transportation,” a roundtable comprised of experts exploring mileage-based user fees. Also known as a vehicle miles traveled taxes, these are per-mile road user charges that helps fund transportation infrastructure and maintenance.

On the panel was Maureen Bock of the Oregon Department of Transportation and program manager of OReGO, Oregon’s road user charge program; Nate Bryer, vice president of innovation at Azuga, a GPS and fleet tracking data company providing the technology for multiple mileage-based user fee programs; and Audrey Wennink, director of transportation at MPC. Moderating the panel was David Schaper, correspondent on NPR’s National Desk based in Chicago.

Bryer opened the conversation with a presentation on Azuga’s technology and where it’s been tested. Azuga has assisted in developing user-friendly account management systems for programs in California, Colorado, and Washington, among other places. Bryer discussed how Azuga’s technology helps provide a tool to determine road user charging by capturing miles driven by users, in addition to providing transportation planning data. “The fuel tax is an elegant tax, probably one of the most elegant taxes known to man,” Bryer said. “The flaw is that it’s single use.”

Bock presented on the OReGO program and gave some background on Oregon’s transportation history. Oregon was the first state to enact a gasoline tax in 1919 and was also the first state to adopt a weight-mile tax in 1947. Oregon also launched the nation’s first user charge program in 2015. Road-user charges (RUC), said Bock, are based on the “user pays principle.”

ODOT’s OReGO program is limited to a maximum of 5,000 passenger vehicles. Volunteers still pay state fuel tax at the pump and a fuel tax credit is applied towards their road usage charge invoices. “Fuel taxes are unsustainable,” Bock said. “RUC is fair and offers additional benefits.”

Some of the challenges, Bock said, have been lack of public awareness among people in Oregon regarding how they’re paying for roads and bridges now. Some issues that have arisen are also the security of user data, the dynamics of being a rural versus urban driver, and income barriers.

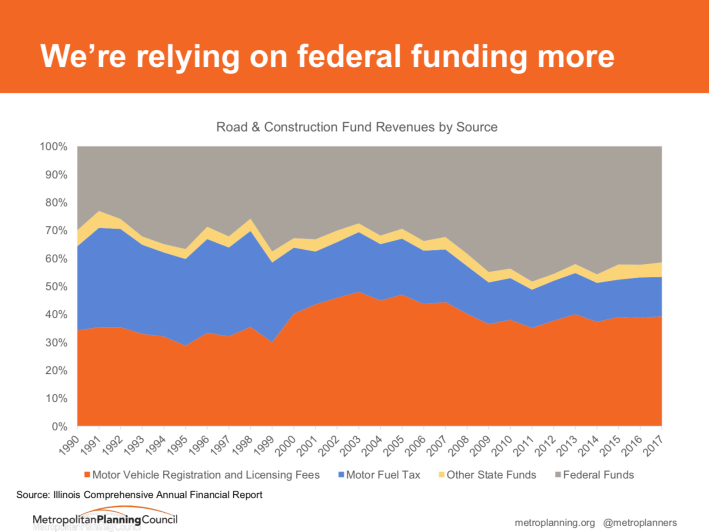

Wennick presented on MPC’s research about mileage-based user fees and how it fits into the context of funding for Illinois transportation infrastructure. In 2017, 42 percent of the Illinois Department of Transportation road funds came from federal funding.

“We’ve been relying on federal funding and not state funding,” Wennick said. The existing funding is insufficient, she said, and MPC determined the state needs at least $43 billion in ten years to get to a place of “good repair” in regards to transit. During the panel discussion, moderated by Schaper, questions of users' data privacy came up. Bryer said that there are clear agreements with their programs so as to not gather user's personal data.

Schaper brought up the question of fuel efficiency, “Aren’t you punishing people who buy cars that are more fuel-efficient?”

“Everyone should pay their fair share,” Bock said. “Fuel taxes have become more regressive because people with less fuel-efficient cars are paying more and subsidizing other people. The most equitable solution is a per-mile rate."

Since road-user charge programs are still a relatively new concept, Schaper asked the panelists to address some of the misconceptions about the technology.

“It’s not an additive, but you may get a tax credit,” Bryer said.

“We’re really just looking for new funding mechanisms for transit,” Wennick said.

After the formal panel, a few questions were taken from audience members in the packed room. One centered on the concern around paying for expensive cars and also paying for roads. “Transportation infrastructure has to be paid for somehow,” Bryer said. “Paying nothing should really not be an option. Not doing anything is not a solution for transportation funding.”

Another audience member asked, “How do we find solutions that are more equitable?”

“It’s an interesting idea to do means testing for people using the roads,” Bock said. “But it’s hard to expect a toddler to run a marathon; the program is really in its infancy.” She added that the fuel tax becomes more regressive as you use it. Wennick added that we need to think about how to transform our system so people aren’t driving as much and having to pay those fees.

Tribune reporter Mary Wisniewski asked a sobering question regarding the political context in Illinois, pointing out that the state hasn’t raised its gas tax since 1991, “How are we going to have a pilot here?”

“We are having this conversation to debunk the myths,” Wennick said. “I’m optimistic that there will be an infrastructure bill this year. If we raise the gas tax, it’s just short-term thinking. We need to future-proof.”

![]()

Did you appreciate this post? Consider making a donation through our PublicGood site.