Last month right-wing Chicago Tribune columnist Kristen McQueary, best known for being nearly universally condemned for writing that she wished that a Hurricane Katrina-like storm would devastate our city, warned readers about the coming regime change in Springfield. She predicted that under new governor J.B. Pritzker and the Democratic majority, the state will see multiple tax hikes, more outlets for gambling, legal marijuana (like that would be a bad thing?), and more borrowing. She chastised voters with the refrain, “This is the government you chose.

McQueary reserved particular scorn for Chicago mayor Rahm Emanuel’s recent proposal to raise the state gas tax to properly fund transit and maintain the state’s roads, bridges, and other transportation infrastructure. Illinois' gas tax has been stuck at a flat 19 cents a gallon since 1990 due to politicians’ perennial fears that raising it would result in a backlash at the polls. (Emanuel isn’t running for reelection.)

“But that doesn’t mean motorists have been getting a deal for the last 28 years,” McQueary wrote. She noted that Illinois drivers also pay the 18.4 cent federal gas tax (which has also been unchanged for decades), and Chicago motorists pay city and Cook County gas taxes, as well as a 10.25 percent sales tax.

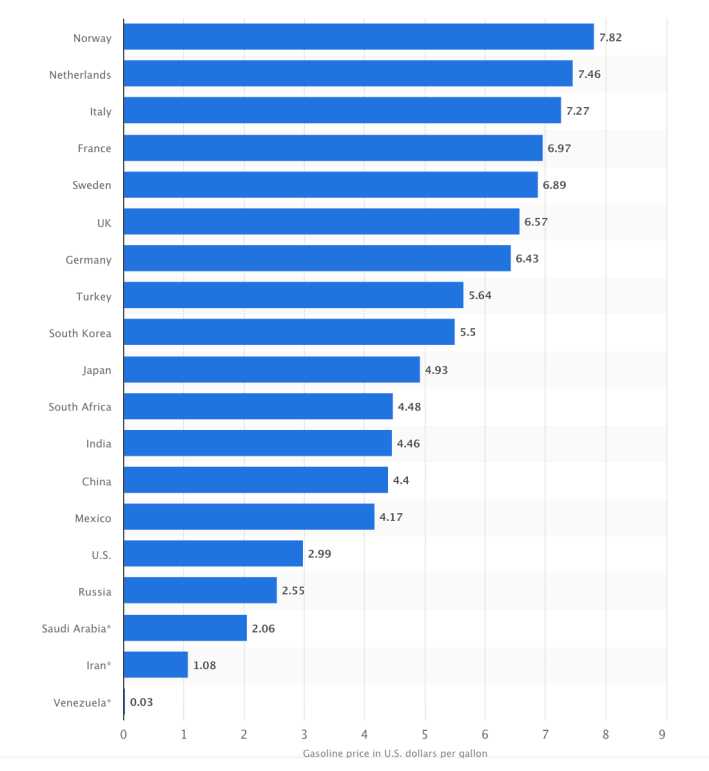

It’s worth noting that gas prices have been falling across the nation lately, and even though gas is more expensive in Illinois than in neighboring states, it was a mere $2.46 a gallon on average in our state as of early December, following a 41-cent drop from the previous month. Moreover, car-friendly U.S. policies keep the national average price of gas to a mere fraction of that in many other countries, as you can see from the chart below. The consequence is poorly funded, crumbling infrastructure, not to mention much worse numbers for traffic fatalities, congestion, and air pollution compared to peer nations.

McQueary noted that Pritzker has indicated that he’s open to raising the gas tax in order to pay for a state infrastructure bill – Illinois hasn’t had one for almost a decade. “That’s an easy sell in Springfield,” McQueary wrote. “Essentially, it’s taking on more debt to pay for hundreds of bricks-and-mortar projects that hardly get vetted. Lawmakers love that… Don’t like paying more at the pump? Too bad. This is the government you chose.”

One valid argument that others have made against hiking the gas tax is that it would disproportionately impact poor and working-class Illinoisans. A possible strategy to reduce the sting of higher prices would be to pair the gas tax increase with legislation to switch the state income tax from a flat rate to a graduated system, where the wealthy pay a higher tax rate, something Pritzker, a billionaire, has voiced support for. Another idea would be to raise the Illinois minimum wage to a living wage of $15 an hour. Admittedly, passing either of these laws would involve non-trivial political battles. But with the Democrats in control again, the time is ripe to take action on these important equity initiatives.

It's also important to remember that if we don't raise the gas tax and stick with the status quo of inadequately funded, infrequent and unreliable transit service in the interest of cheap gas, that disproportionately hurts people who can't afford to own a car or are unable to drive. That's way more regressive than making gas somewhat more expensive for those who drive.

I checked in with local transportation advocacy organizations for their take on McQueary’s op-ed. Metropolitan Planning Council transportation director Audrey Wennink said she agreed with the columnist that Illinois should not take on more debt to pay for hundreds of projects that hardly get vetted. But she added that raising the state gas tax makes sense.

“The conversation in Illinois must be about sustainable transportation funding sources, transparency and getting the most return on every tax dollar,” Wennink said. “Illinois residents’ quality of life is suffering from lack of investment. The Metropolitan Planning Council’s #BustedCommute social media campaign over the past year is filled with stories of Illinois residents dealing with daily frustrations from poorly maintained transit, bike lanes, sidewalks, roads, and bridges. Since our state motor fuel tax has not been indexed to inflation and has steadily lost purchasing power over nearly 30 years, we need to take action, like most states have done in recent years.”

Wennink added that we need to make sure that funding is sustainable, meaning that dependable revenue comes in every year that allows us to plan and pay as we go. “But any increased revenue for transportation also must be accompanied by policy changes to ensure transparent use of transportation funds,” she said. “This approach is called performance-based planning. It means that every project is fully vetted and compared to other options so our investments move the most people quickly and safely.”

For example, if we took this more holistic approach, the state would likely abandon the Illinois Department of Transportation’s current plan to widen Chicago-area expressways in a futile attempt to reduce congestion. Instead, decision-makers might choose alternatives to highway expansion like beefing up transit service and transportation demand management.

Active Transportation Alliance director Ron Burke agreed that a state gas tax hike would be an appropriate way to fund long-overdue updates and upgrades to Illinois’ transportation network. “Our Illinois Sustainable Transportation Platform calls for a sustainable revenue source -- of which gas tax is likely part -- to fund improvements to the state’s transportation infrastructure,” he said. “We’re calling for at least 40 percent of transportation capital spending in any revenue bill to go towards public transit projects. We’re also looking to pass a bill next session to establish an Illinois Bike Walk Fund where two percent of state transportation capital spending annually would go towards biking and walking projects.”

McQueary’s recent column certainly isn’t as outrageous as her previous piece that wished that a storm with high winds would ravage Chicago. But her argument that the long-delayed increase in the state gas would be an unjust burden on drivers is a bunch of hot air.

![]()

Did you appreciate this post? Consider making a donation through our PublicGood site.