A new report by the Metropolitan Planning Council finds that Illinois needs to invest $43 billion over the next decade to get its roads, bridges, and transit lines in a state of good repair. This is a daunting number, especially for a state that has gone over nine months without a budget plan. However, the nonprofit argues that this goal is achievable if leaders recognize the importance of facing the problem head-on by creating a new funding stream, rather than dealing with the costly consequences of continuing to neglect our transportation network.

“The $43 billion needed to rebuild and improve our transportation infrastructure is less than what we’re wasting today on vehicle repairs due to poor road conditions, time lost to traffic congestion, and population and jobs going to neighboring states,” said MPC senior fellow Jim Reilly in a statement. “To reverse these costly trends, we need a significant, reliable state revenue source dedicated to infrastructure investment.”

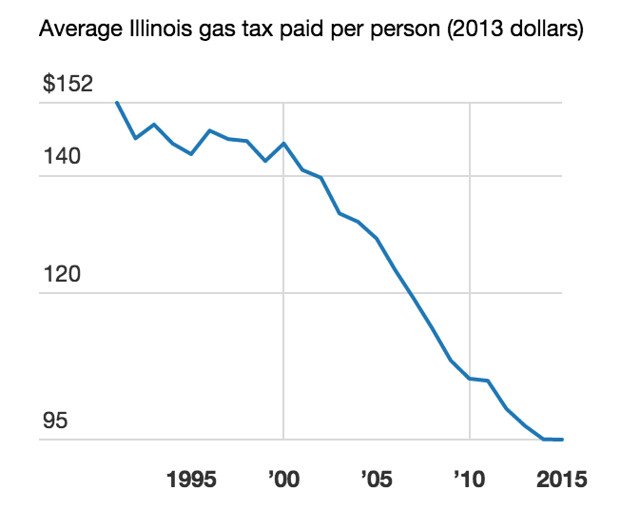

The new study notes that Illinois’ fixed, per-gallon gas tax was last raised in 1991. During the quarter of a century that followed, the purchasing power of the tax has dropped by over 40 percent. The average Illinois resident’s contribution to the gas tax fund has declined from the equivalent of $160 to less than $100 (in 2013 dollars). As a result, the state is spending 40 percent less money on transportation infrastructure than it did 25 years ago.

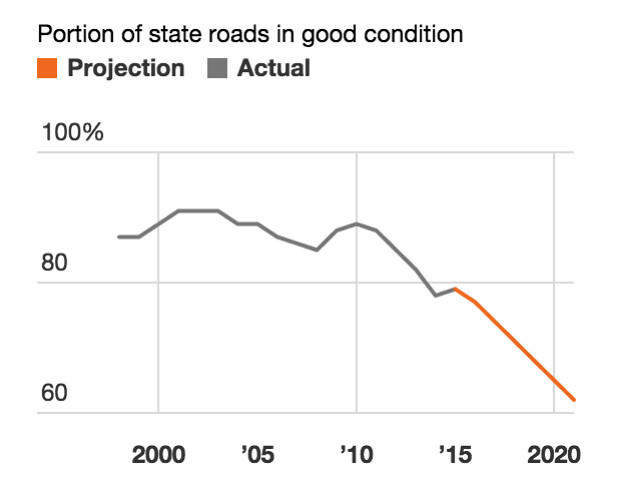

The report finds that, as a result of Illinois’ lack of investment in rebuilding infrastructure, one out of five roads in the state is in a state of disrepair. The group says twice as many roads will be in poor condition by 2021 if we continue this trend.

Similarly, the Regional Transportation Authority says that only about two-thirds of Chicagoland’s transit network is in a state of good repair. That will drop to less than half of the network by 2030 if we don’t take action.

MPC argues that the state’s recent strategy of passing large but sporadic capital bills to pay for infrastructure improvements has created an inefficient “boom-and-bust” cycle. They say a much better solution would be to raise the state gas tax by 30 cents per gallon, and increase vehicle registration fees by 50 percent. Both increases would be indexed to inflation, so that there wouldn’t be a loss of purchasing power.

The study finds that these hikes would only cost the average Illinoisan $12.25 a month, or $147 a year. The average household in our state spends over $10,000 a year in transportation costs, according to MPC. “For the monthly cost equivalent to one take-out lunch or a Netflix subscription, Illinoisans can have roads, bridges and transit that actually work,” Reilly said.

It’s a commonsense solution to an urgent problem, but getting Springfield lawmakers to sign on to the proposed gas tax and registration fee increases may be a challenge. Not only are raises to these types of user fees widely viewed as political Kryptonite, but Republican governor Bruce Rauner has been crusading against tax increases of any sort.

But hopefully MPC will be successful in their latest campaign to speak truth to power and persuade politicians that action must be taken before Illinois has a transportation infrastructure crisis on its hands. After all, an ounce of prevention is worth a pound of cure.