The Active Transportation Alliance has launched a petition where you can voice your support for fair ride-hail fees and better CTA service to elected officials. Add your name to the petition here.

Chicago mayor Lori Lightfoot's proposal for a new ride-hail tax structure will be great for reducing congestion and funding better transit service. It will discourage traffic-clogging single-passenger rides downtown during peak hours, and encourage current Uber and Lyft customers to swap private trips for cheaper, more sustainable shared Uber Pool and Lyft Line rides, as well as generating an estimated $2 million a year to improve the CTA.

Of course, fewer private Uber and Lyft trips would be bad for the companies' bottom lines, but they're not being honest about their real reason for opposing the measure. Instead, they're cynically trying to misrepresent the plan as something that would hurt poor and working people, and Chicagoans of color. Here's a sample of the misleading statements Uber, Lyft, and their proxies have made recently about Lightfoot's proposal being inequitable, which I'll debunk below.

- The fee structure amounts to a nearly 80 percent tax increase on South and West sides trips.

- "It will take money out of the pockets of riders -- half of whom live in the South and West sides"

- "The plan balances the budget on the backs of low-income communities.”

- "There are better ways to raise revenue without hurting those who can afford it least."

- "Do not tax our people,” spoken by South Side minister Reverend Walter Turner.

It's important to acknowledge that Uber and Lyft have had benefits for South and West side residents and Chicagoans of color. For example, they provide rides in parts of town that taxi drivers don't normally frequent, and make it harder for drivers to discriminate against Black and Latino residents, which has been a major problem with traditional cabs. They can also fill in gaps in the transit network by providing "first- and last-mile" trips to the 'L' and Metra. In the near future I'll be interviewing community leaders and mobility justice advocates from the South and West sides to provide some additional points of view on the ride-hail tax issue.

But in the meantime, it's not hard to demonstrate how Uber and Lyft's claims that the new tax structure would hurt South and West siders and lower-income residents are false. In fact the opposite is true.

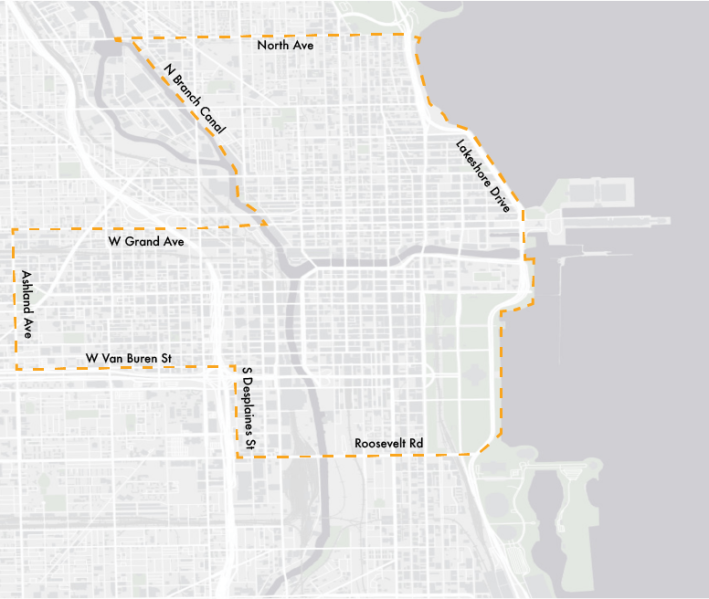

First, let's recap what Lightfoot's proposal would actually do. Currently, all Uber and Lyft trips are charged the same total tax rate of $0.72, regardless of whether the trips is hailed in Englewood or the Gold Coast; whether it's a private or shared trip; and whether it's taking place during rush hour or 3 a.m. Under the new structure:

- The total tax on Uber Pool or Lyft Line trips in the neighborhoods would drop from $0.72 to $0.65, a seven-cent discount and a 10 percent decrease.

- The total tax on a private ride in the neighborhoods would increase from $0.72 to $1.25, a 53-cent or 74 percent increase.

- The total tax on an Uber Pool or Lyft Line to or from downtown during peak hours (6 a.m. to 10 p.m. on weekdays) would increase from $0.72 to $1.25, a 53-cent or 74 percent increase.

- The total tax on a private downtown ride during peak hours would increase from $0.72 to $3.00, a $2.28 or 317 percent increase.

So people traveling between neighborhoods via Uber Pool or Lyft Line, a relatively sustainable type of trip, would save a little money. Most other kinds of rides would only go up by 53 cents -- that's about the price of a round of pinball, and shouldn't be a major hardship for most Chicagoans who can currently afford non-shared rides or taking ride-hail downtown.

Sure, the $3 surcharge on private downtown rides during peak hours -- the number that Uber and Lyft are emphasizing in their propaganda -- is nothing to sneeze at. But that type of ride is particularly likely to be taken by more affluent white-collar types. Moreover, we don't expect daytime Loop parking to be cheap. Likewise, being chauffeured downtown in a private car during the business day is a luxury that should be taxed as such. And it's a major source of traffic jams in the transit-rich Loop, so it's a type of trip we should discourage.

When addressing Uber and Lyft's claim that the new tax structure would be unfair to poor people, it's important to note that the status quo of a flat $0.72 tax is regressive. As transportation experts and advocates noted in a letter to Lightfoot in June, that fee represents a much higher percentage tax on shared rides than on more expensive private rides of the same length, which disproportionately impacts lower-income and working Chicagoans, since they're more likely to opt for Uber Pool or Lyft Line.

It also means that if you're a blue-collar worker taking ride-share a mile or two from your home in Austin to the Green Line to get to your downtown job, you're paying the exact same amount of tax as a CEO who chooses to take an Uber seven miles from his home in Ravenswood to his office on LaSalle Street instead of riding the Brown Line. (Granted, a working person could potentially take ride-hail all the way downtown as well, but they're much less likely to opt for such an expensive long-distance trip.) The new fee structure corrects that inequality.

While flat taxes like the current $0.72 fee are regressive, a progressive tax is one where wealthier people pay a higher rate and poor and working people pay a lower rate. An example of that is Illinois governor J. B. Pritzker's proposal to replace the state's flat income tax rate of 4.95 percent with a "fair tax." Under this plan, the wealthiest 3 percent of Illinoisans, who can afford to pay a higher percentage of their income, would do so, while people making $250,000 or less would pay at the current rate or get a tax cut.

Our state doesn't have income-based tax rates on goods and services, but Lightfoot's ride-hail proposal would function in a similar way. It's essentially an equity-minded "Robin Hood" tax because the fee increases will mostly affect wealthier people, while lower-income and working Chicagoans and people of color will tend to get a discount. Here's why.

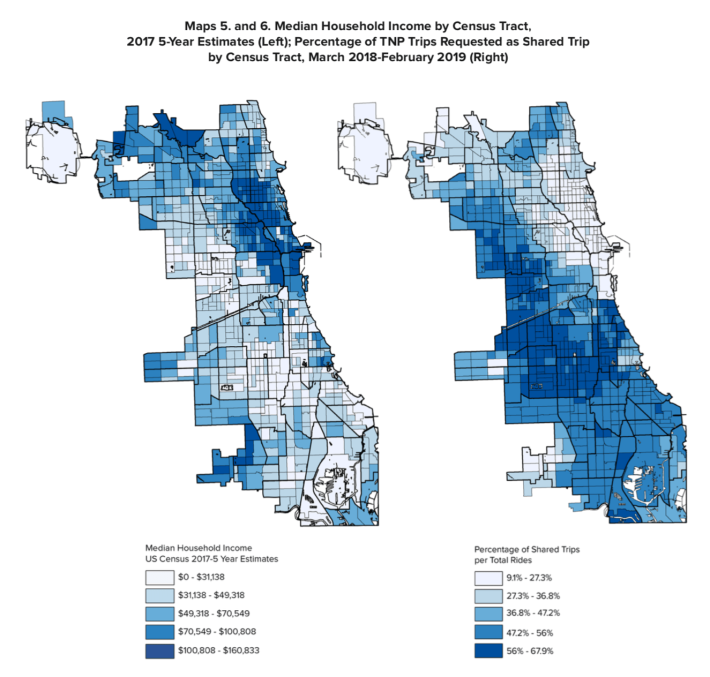

According to a recent city of Chicago study, more than half of Uber and Lyft trips currently hailed on the South and West Sides are shared trips, and about 90 percent of trips hailed in those areas are going to non-downtown locations. Therefore, as it stands, over 50 percent of South and West ride-hail users will enjoy the 10-percent tax discount.

So rather than the new fee structure "amount[ing] to a nearly 80 percent tax increase on South and West sides trips" as the companies claim, it's really a 10 percent tax decrease on most South and West Side trips. And the percentage of these trips that are shared is sure to increase to significantly after the new fees are in place and shared trips cost a full 60 cents less in tax than private ones,

Meanwhile, only about 30 percent of trips currently hailed on the North Side and downtown are shared. Therefore, Chicagoans hailing trips in these areas, who tend to be relatively affluent, will be more likely to pay additional tax under the new plan, subsidizing the cheaper shared rides for their South and West side counterparts.

On top of that, the decrease in bus-slowing traffic congestion and the estimated $2 million in new funding for the CTA, will disproportionately benefit South and West side residents, who are more likely to be transit-dependent.

Granted, Lori's plan isn't perfect. We should take any necessary steps to prevent the new fee structure from unduly impacting people with disabilities, women (some female Streetsblog readers have told me they feel safer in private rides than shared ones), and ride-hail drivers. Possible solutions to help the latter group include a cap on the number of drivers (which would further help ease congestion), and an ordinance requiring Uber and Lyft to pay their workers a higher commission.

But overall, Lightfoot's plan, which recognizes that shared trips in the neighborhoods shouldn't be taxed as high as traffic-jamming private downtown rush-hour rides, will be a win for economic equity and racial justice.

Click here to add you name to Active Trans' petition in support of the fair ride-hail tax plan.