The Most Effective Investments Are Ones That Change Travel Behaviors

3:15 PM CDT on October 6, 2017

There is a lot of construction around the Morgan station, which is attributed as fomenting some of the development. Photo: Daniel Ronan

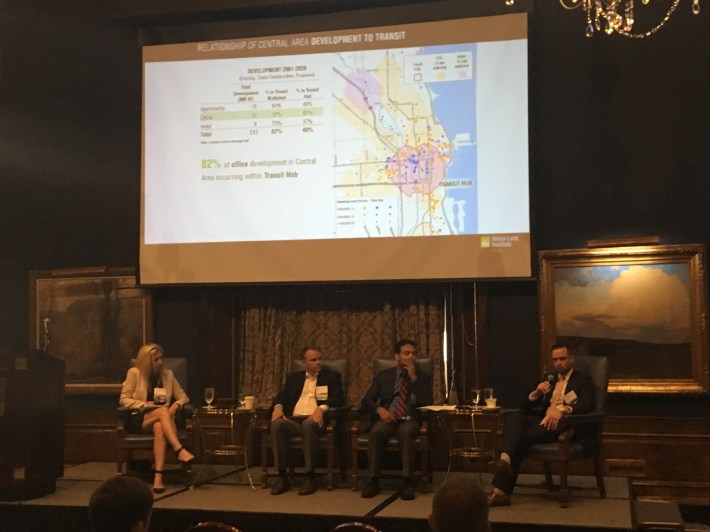

The CTA's Morgan Green and Pink line station has had a major impact on the West Loop real estate market, and a recent panel hosted by the Urban Land Institute set out to find just how great its influence has been. The panelists were two developers and an economic analyst, who broke down the ways in which the city's transit infrastructure investment successfully spurred the development of new office buildings around the station. The station was built by the Chicago Department of Transportation on the CTA's behalf, and it opened in 2012.

The panelists noted that investments in public infrastructure in neighborhoods that are easy to access from other parts of the region by transit (the West Loop is home to both Union Station and the Ogilvie Center, which provide Metra commuter rail service from many suburbs) further enhance real estate values. That in turn raises property costs, property taxes, and rents, so it raises the question of how we can make infrastructure investments while creating and maintaining affordable places to live.

John Gavin of the real estate development company Sterling Bay noted that it's estimated that over $3 billion in real estate activity resulted from the construction of the Morgan stop, with over $1 billion in construction coming from his firm alone.

The Morgan station is seeing a high level of ridership. The average weekday passenger boardings onto Green and Pink line trains in May 2017, the last month for which data is available, was 2,947 people. I n comparison Ashland, another Green and Pink station one stop to the west, has 2,434 total average weekday boardings. In fact, Morgan has the second highest ridership on the Lake Street elevated, after the Clinton stop.

Sterling Bay is currently constructing four separate office buildings in the West Loop's Fulton Market district, including the forthcoming 600,000-square-foot McDonald's corporate headquarters.

Gavin said that, for various reasons, it can be challenging to include no more than the appropriate number of car parking spaces in a project. He noted that the new McDonald's headquarters, located a block west of the Morgan station, will have 300 spaces for its 3,000 employees, a 1:10 ratio of spaces to employees. However, at the new Google headquarters, a block north of the stop, there are 300 parking spaces, but the 650 Google workers are only using 24 spaces -- that'a only a 1:27 ratio of spaces used to employees. (Other tenants may also use the spaces.)

In general, developers must comply with zoning that sets minimum parking requirements, which hamstrings their ability to only include the amount of parking that's likely to be used. It also greatly increases construction costs, which are then passed on to tenants. Fortunately, in recent years Chicago's transit-oriented development ordinance has essentially waived the parking requirements for new construction near train stations. However, the city should go a step further by abolishing parking minimums citywide and allow the developers and community members to decide how much car parking, if any, a project requires.

Real estate developers looking to raise the value of their properties, and government officials who hope to increase tax revenue tend to be fans about large neighborhood infrastructure investments. And when these investments are sustainable transportation amenities like the $38 million Morgan station or the $95 million Bloomingdale Trail, aka The 606, on the Near Northwest Side, livable street advocates also tend to be enthusiastic.

However, these investments can be a double-edged sword. For example Bloomingdale has inspired a real estate gold rush, which many Humboldt Park and Logan Square residents say is accelerating the displacement of longtime residents as property values, property taxes, and rents climb. A recent report from DePaul’s Institute for Housing Studies found that property values along the western stretch of the elevated path have gone up by 48.2 percent since construction began on the greenway.

Panelist Ranadip Bose of SB Friedman Development Advisors noted that developers' and politicians' affinity for big infrastructure projects is logical, and more funds could be raised for these initiatives through density bonus fees, for example. Chicago has the Neighborhood Opportunity Bonus fee, which firms developing in downtown Chicago can pay in order to build bigger, 10 percent of which goes to fund nearby public infrastructure projects, which could be anything from a train station renovation, to a library expansion.

This fee-based model differs from direct public investment (which is how the Morgan station was funded) in that it allows developers to help pay for the infrastructure needed to support their projects. This could be a possible scenario in the case that the city is able to attract Amazon's new corporate headquarters.

But what about Chicago neighborhoods that aren't as regionally connected as the Loop, River North and the West Loop? The panelists said little about how private real estate investment could benefit neighborhoods on the South and West sides. Gavin stated that he would not want to dictate where the city of Chicago invests its money, but he emphasized that the developers may require subsidies to build underperforming real estate markets.

To help address this market disparity, more can be done to lessen the costs of development, such as the elimination of car parking requirements, in conjunction with strategies to change to encourage car-free commuting. One aspect of making neighborhoods affordable places to live is to provide transportation options that allow people to get where they need to go without having to take on the expense of owning and operating a car.

Large infrastructure investments such as the Bloomingdale, and now the just -announced 312 RiverRun Trail along a two-mile corridor on the North Side, play into the speculative nature of the real estate world. As an alternative, prescriptive policies such as requiring companies with ten or more employees to adopt the Regional Transportation Authority’s popular pre-tax transit pass program would make it cheaper for workers to ride transit. Integrating CTA, Metra, and Pace fares, so that riders don't have to pay full price when they transfer from one system to another would make transit more affordable, as well as encouraging more ridership.

Policies which do not require wholesale changes to the zoning code, but substantive changes in our land use and transportation practices and individual behaviors lessen the restrictive burden on developers and property owners alike. For example, if zoning was changed to allow homeowner to build a unit above their garage to rent out to help pay off their mortgage, that could assist residents with making ends meet. These policy changes would help magnify the return of future public investments, allowing us to make more efficient use of our public resources and incentivizing development in neighborhoods that need it most.

Stay in touch

Sign up for our free newsletter

More from Streetsblog Chicago

Today’s Headlines for Thursday, April 18

Roger that! Streetsblog SF editor Roger Rudick offers constructive criticism of Chicago’s downtown bike network

"There were blocks that felt very safe and very secure," he said. "But then you're immediately – voom! – disgorged into three lanes of moving traffic with no protection."

City announces $2M federal grant to address harms caused by I-290 by improving walk/bike/transit access

The Mayor's Office says the money will fund "improvements for people walking and bicycling on existing streets and paths surrounding and crossing the corridor."